montana sales tax rate 2020

Both these taxes are collected by the facility from the user and remitted to the Department of Revenue. Montana Tax Brackets 2019 - 2020.

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

The lowest state and local sales taxes after Alaskas are in Hawaii 444 percent Wyoming 534 percent Wisconsin 543 percent and Maine 55 percent.

. The latest sales tax rate for Yellowstone County MT. Rates include state county and city taxes. Montana has several taxes covering specific businesses services or locations.

The latest sales tax rates for cities in Montana MT state. The December 2020 total local sales tax rate was also 0000. You may qualify for MT QuickFile if you.

There is 0 additional tax districts that applies to some areas geographically within Missoula. 2020 rates included for use while preparing your income tax deduction. Sales Tax Rates by City.

State Business Tax Climate Index. Lodging Facility Use Tax see 15-65-101 MCA through 15-65-131 MCA. Montana has a 675 percent corporate income tax rate.

The latest sales tax rate for Eureka MT. The states general fund revenues grew modestly in FY 2020 despite the pandemic and is running substantially higher in FY 2021 with forecasts showing. Looking at the tax rate and tax brackets shown in the tables above for Montana we can see that Montana collects individual income taxes similarly for Single versus Married filing statuses for example.

Montana does not have a state sales tax and does not levy local sales taxes. Montana charges no sales tax on purchases made. Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy.

Five states do not have statewide sales taxes. Montanas tax system ranks 5th overall on our 2022 State Business Tax Climate Index. You can use our Montana Sales Tax Calculator to look up sales tax rates in Montana by address zip code.

Following Tennessee on the ranking of the states with the highest sales. 2020 rates included for use while preparing your income tax deduction. 2020 rates included for use while preparing your income tax deduction.

The state sales tax rate in Montana is 0 but you can. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. State and Local Sales Tax Rates.

State State Tax Rate Rank Avg. 368 rows There are a total of 73 local tax jurisdictions across the state collecting an average. This rate includes any state county city and local sales taxes.

As of July 1 2020. The Missoula sales tax rate is NA. We can also see the progressive nature of Montana state income tax rates from the lowest MT tax rate bracket of 1 to the.

MT QuickFile is for filing a Montana State Tax Return. Montana has a modestly progressive personal income tax. Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including.

File Single Head of Household or Married Filing Jointly Claim a standard deduction Are a Full-Time Montanan Only report income from Forms W-2 1099-INT or 1099-DIV Are not claiming any credits except the Montana Elderly HomeownerRenter Credit. Montana has a graduated individual income tax with rates ranging from 100 percent to 675 percent. The Montana State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Montana State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Alaska Delaware Montana New Hampshire and Oregon. These taxes include telecommunications tobacco tourism cannabis and health care facilities among others. The December 2020 total local sales tax rate was also 0000.

State. ARM 4214101 through ARM 4214112 and a 4 Lodging Sales Tax see 15- 68-101 MCA through 15-68-820 MCA for a combined 8 Lodging Facility Sales and Use Tax. The December 2020 total local sales tax rate was also 0000.

The top tax rate of 69 is the 13th highest in the nation but Montana is one of only six states that allows Federal taxes to be deducted on the state return. On the other end of the spectrum is Tennessee whose state sales tax is 955 percent the highest in the US. 2020 rates included for use while preparing your income tax deduction.

Consumer Counsel Fee CCT Contractors Gross Receipts Tax CGR Emergency Telephone System Fee. The latest sales tax rate for Bigfork MT. 2022 Montana Sales Tax Table.

Sales tax region name. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. The Montana Department of Revenue is responsible for publishing the.

The state sales tax rate in Montana is 0000. This rate includes any state county city and local sales taxes. This rate includes any state county city and local sales taxes.

The recent Montana tax reform package made several changes to individual and corporate taxes. Tax rates last updated in April 2022. There are no local taxes beyond the state rate.

Table 4Top Tax Rates on Ordinary Income California Colorado Idaho Montana Nevada North Dakota Oregon South Dakota Utah Washington.

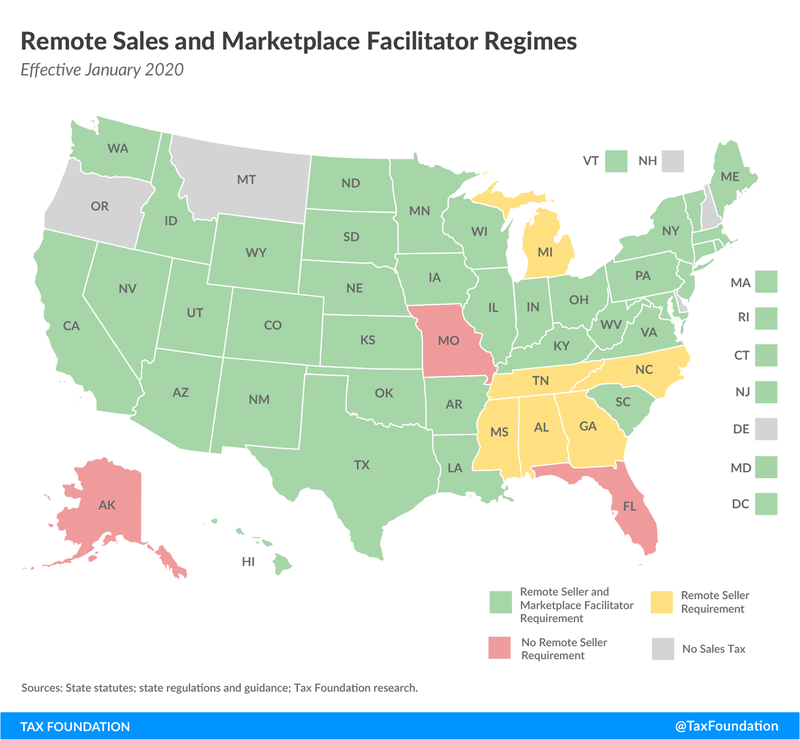

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

What Is The Harris County Sales Tax The Base Rate In Texas Is 6 25

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

States With Highest And Lowest Sales Tax Rates

States Without Sales Tax Article

How Is Tax Liability Calculated Common Tax Questions Answered

U S Sales Taxes By State 2020 U S Tax Vatglobal

Montana Tax Information Bozeman Real Estate Report

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

Is Buying A Car Tax Deductible Lendingtree

Sales Tax By State Is Saas Taxable Taxjar

Sales Taxes In The United States Wikiwand

A Small Business Guide To E Commerce Sales Tax

How Is Tax Liability Calculated Common Tax Questions Answered